About Us

ASHOK PAREKH

Our journey began in 2001 when our founder stepped into the insurance world as a LIC agent. Over the years, he expanded his expertise by partnering with several leading insurance companies, specializing in general insurance. Today, he offers comprehensive insurance solutions, covering life, health, and general insurance.

With years of experience, he has guided clients through complex claims and ensured their peace of mind. Our client relationships are built on trust, transparency, and exceptional service in every interaction. Through dedication and a client-first approach, we have established tie-ups with multiple insurance companies, allowing us to offer a wide range of products tailored to your unique needs.

At the heart of our work is a simple philosophy: to protect what matters most to you, with care, commitment, and confidence.

PARTH PAREKH

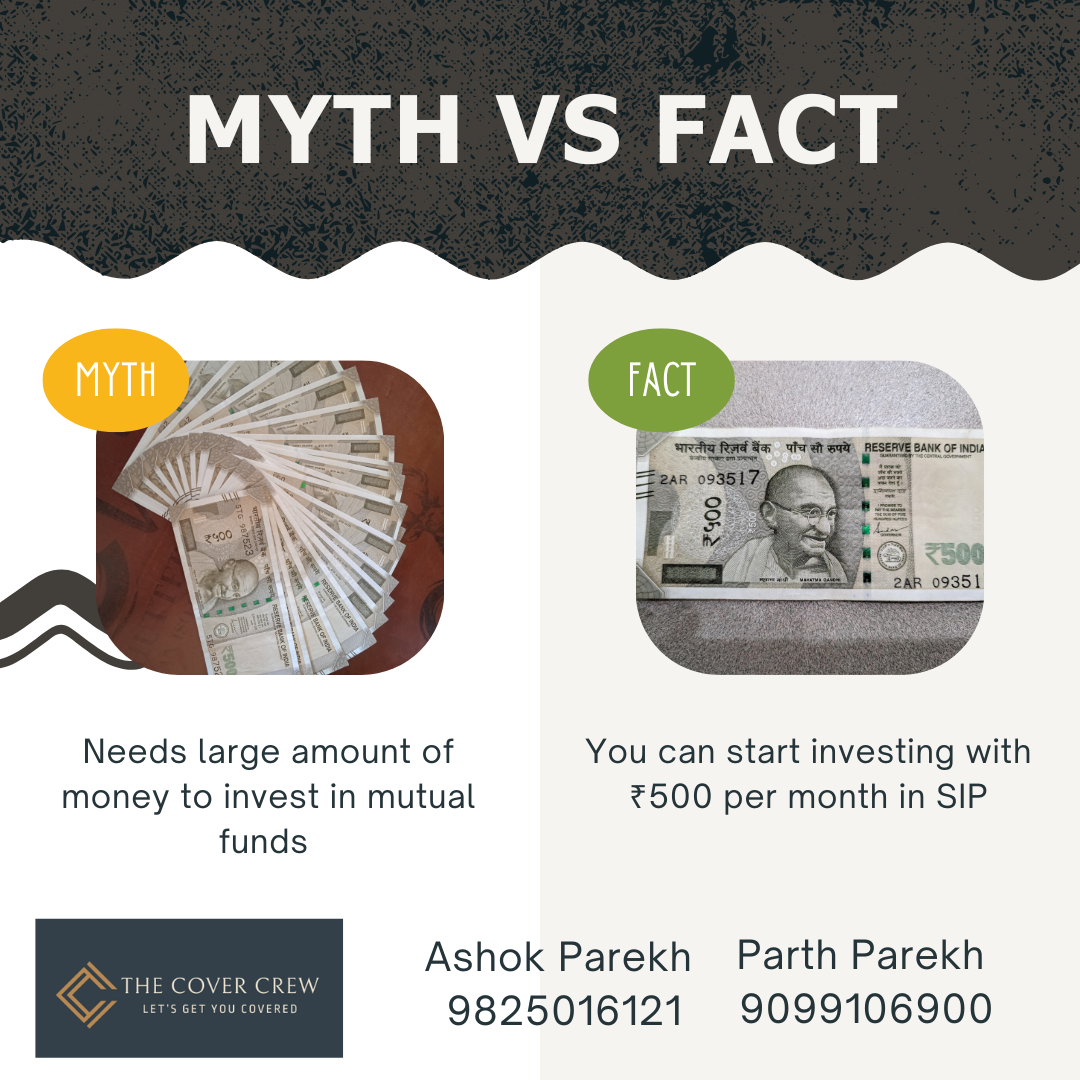

Our journey began in 2012 when our founder entered the insurance world as a LIC agent. In 2013, he expanded into health and general insurance, helping clients secure their present and future. Recognizing the evolving financial needs of individuals, he ventured into mutual funds and other investment avenues—equity, debt securities, and liquid funds—in 2017.

Founded on the principles of trust, transparency, and financial literacy, our firm is committed to guiding clients through every stage of their financial journey. With years of experience, we have assisted individuals in diverse financial situations—whether starting their investment journey, planning for retirement, or managing wealth across generations. Our focus is to provide informed, customized financial solutions that empower our clients to achieve their goals with confidence.

About Our Company

High Range of Exploring Protection

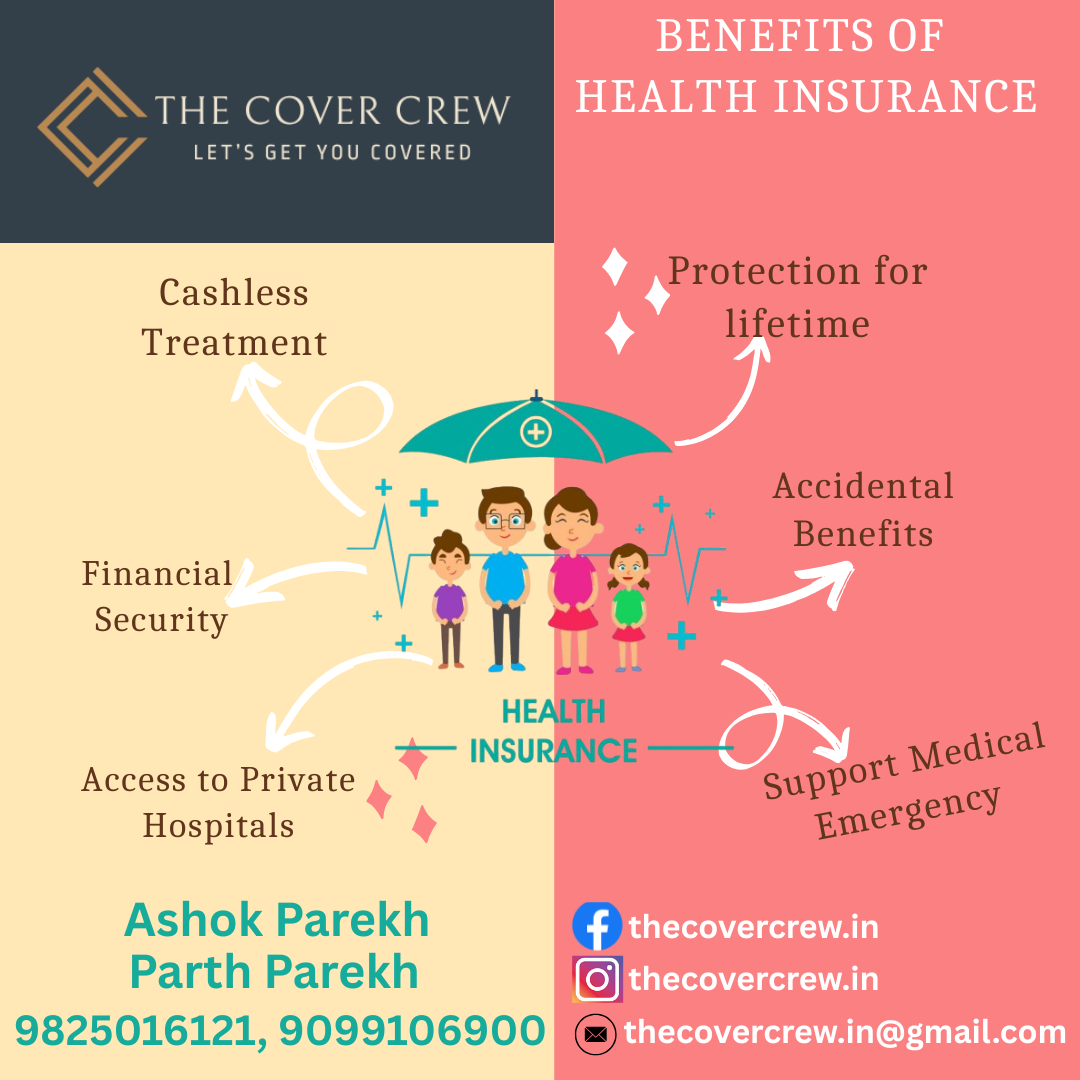

At The Cover Crew - by Ashok Parekh, we believe insurance is not just about policies—it’s about building security for your life and loved ones. We work with top insurance companies to bring you the best options in life insurance, health insurance, motor insurance, fire insurance, home insurance, and investment-linked plans.

Expert Guidance – Honest, transparent advice

Tailored Solutions – Plans that fit your lifestyle

Long-Term Support – Assistance beyond just policy buying

Insurance Policies

Happy Clients

Claims Assisted

Awards WON

Associated Companies

Some Important FAQ's

Common Frequently Asked Questions